december child tax credit check

When does the December child tax credit payment arrive. This means that the total advance payment amount will be made in one December payment.

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

The December check will arrive through direct deposit for millions of parents on Dec.

. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. This is not the first time lawmakers have sweetened the credit. Instead of calling it.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per child under 6 and 3000 per child. The advance is 50 of your child tax credit with the rest claimed on next years return. Eligible families who did not.

Filed a 2019 or 2020 tax return and. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. You should look for the.

What we know so far When you file your 2021 tax return in 2022 you will need to report the amount of monthly child tax credit payments you received in. Child tax credit 2022. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Well tell you when this payment will arrive and how to unenroll. When does the Child Tax Credit arrive in December. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

Who is Eligible. Monthly Child Tax Credit checks could stop 0759. Only one child tax credit payment is left this year.

Every month a new payment of up to 300 per child hit parents. 2 days agoTHE final child tax credit payment of 1800 is still up for grabs and heres how to get it. The enhanced child tax credit will total 3000 per child ages 6 through 17 and 3600 per child 5 and under.

Back in July parents across the United States started getting advance payments on their child tax credit. Ad The new advance Child Tax Credit is based on your previously filed tax return. Americans who qualify for enhanced Child Tax Credit benefits might be getting their final advance payments this week as the program is slated to wrap up on Dec.

While the monthly payments ended in December the final payment will be sent out with. The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. Claim the full Child Tax Credit on the 2021 tax return.

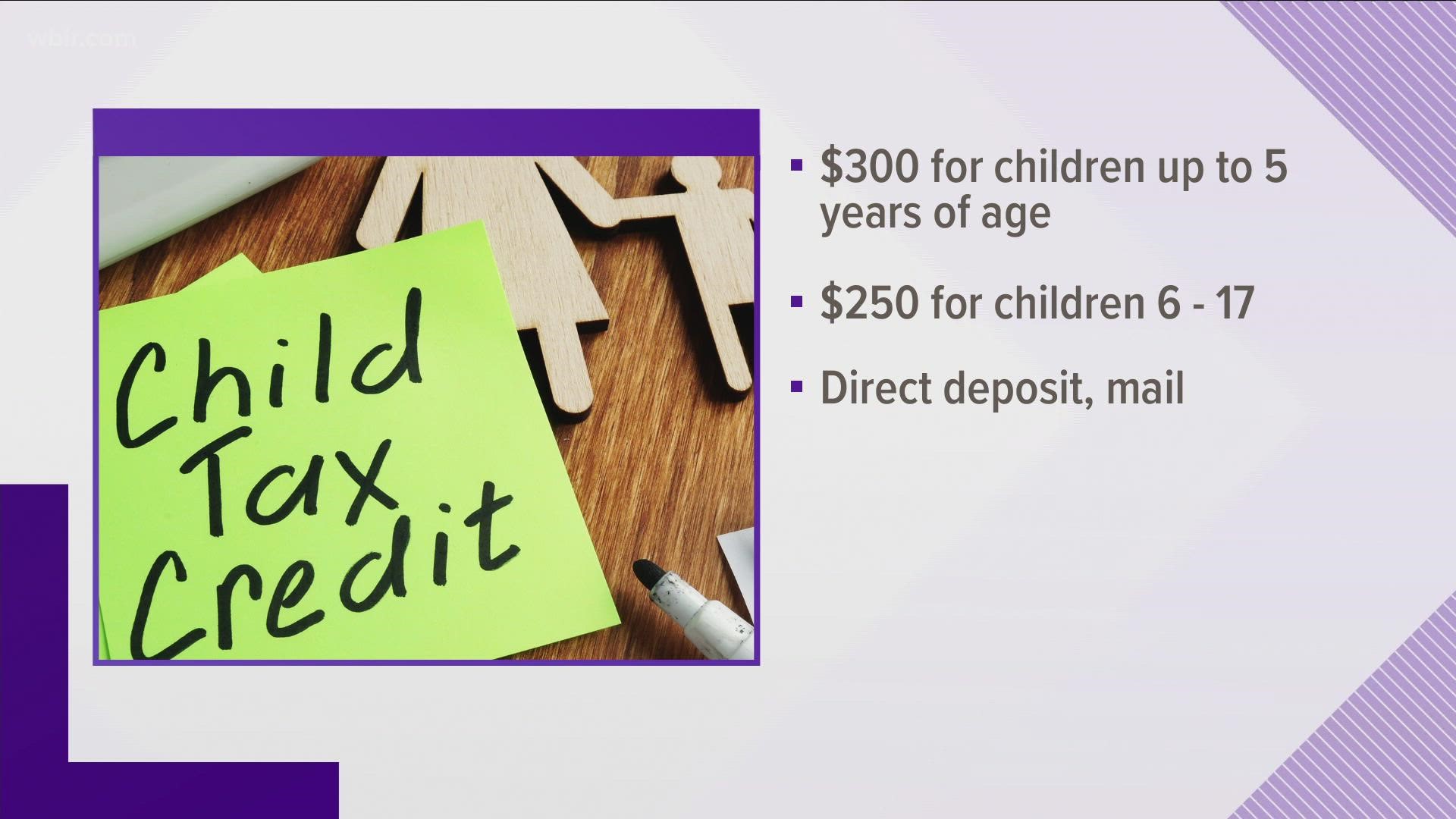

Child tax credit enhancement. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17. Eligible families who did not opt out of the monthly payments are receiving 300.

Millions of Americans have weathered the COVID-19 pandemic with the help of direct cash payments from the US. The amount parents receive depends on the age of the child. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis.

Child Tax Credit December Payment Will See Some Families Get 1 800 Per Kid In Just 4 Days Are You Eligible

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit December Will This Week S Payment Be The Last One Marca

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

August Child Tax Credit Payments Issued Here S Why Yours Might Be Delayed Wgn Tv

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Update Next Payment Coming On November 15 Marca