wisconsin used car sales tax calculator

Wisconsin is one of several states that taxes regular gasoline and diesel fuel at the same rate. Important Changes Menominee County tax begins April 1 2020 Baseball stadium district tax ends March 31 2020 Outagamie County tax begins January 1 2020 Calumet County tax begins April 1 2018.

States With Highest And Lowest Sales Tax Rates

Sales and Use Tax.

. Every state has a different way of calculating the fees for used cars. Groceries and prescription drugs are exempt from the Wisconsin sales tax. All calculations are estimates based on all known state excise sales and environmental taxes and fees levied on gasoline plus vehicle registration renewal fees as of January 1 2021.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. The total amount represents the various taxes and fees which are used to build and maintain Wisconsins roads. If you properly paid sales tax in another state the sales tax paid may be used to offset the Wisconsin use tax due.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. There are also county taxes of up to 05 and a stadium tax of up to 01. The national average state and local sales tax by.

Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. WisDOT collects sales tax due on a vehicle purchase on behalf of DOR.

Wisconsin Mobile Home Tax. You pay tax on the sale price of the unit less any trade-in or rebate. Wisconsin has 816 special sales tax jurisdictions with local sales taxes in.

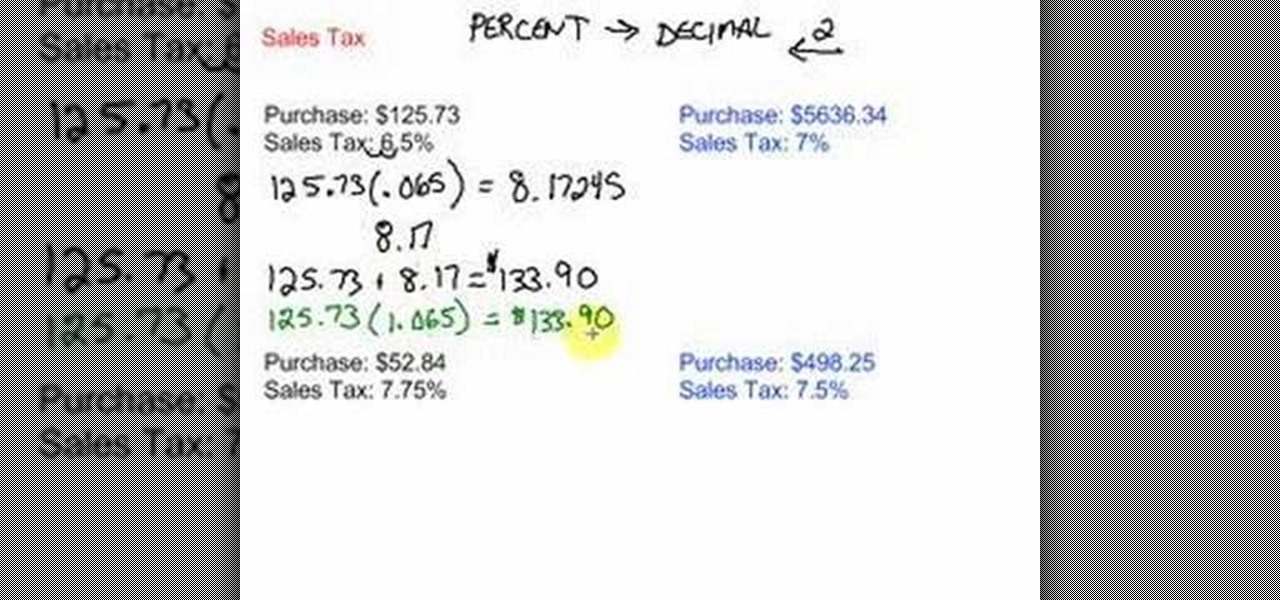

This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. Remember to convert the sales tax percentage to decimal format. Wisconsin allows a credit for sales tax properly paid in another state against use tax due.

See our manual car tax calculator and use the override option to fine tune your auto loan quote. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

425 Motor Vehicle Document Fee. All calculations are estimates based on all known state excise sales and environmental taxes and fees levied on gasoline plus vehicle registration renewal fees as of. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Car tax as listed. In our calculation the taxable amount is 41449 which equals the sale price of 39750 plus the doc fee of 249 plus the extended warranty cost of 3450 minus the trade-in value 2000.

In addition to taxes car purchases in Wisconsin may be subject to other fees like registration title and. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of RevenueFor example the state and local sales tax on vehicles registered in Bayfield County is 55 percent. You may be penalized for fraudulent entries.

Wisconsin used car sales tax calculator. Wisconsin has a 5 statewide sales tax rate but also has 265 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 046 on top. 3090 cents per gallon.

30000 8 2400. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be. 635 for vehicle 50k or less.

Call DOR at 608 266-2776 with any sales tax exemption questions. Some dealerships also have the option to charge a dealer service fee of 99 dollars. Select view sales rates and taxes then select city and add percentages for total sales tax rate.

See Wisconsin Tax Bulletin 157 page 28 for further information. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. 775 for vehicle over 50000.

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. Multiply the net price of your vehicle by the sales tax percentage.

Vehicle Use Tax and Calculator Questions and Answers April 2020 If you recently purchased a vehicle from an out-of-state dealer and plan to register it in Arizona you may owe use tax. Subtract these values if any from the sale. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Calculating Sales Tax Summary. DMV fees are about 318 on a 39750. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. Motor Vehicle Sales Leases and Repairs.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Wisconsin Department of Revenue DOR reviews all tax exemptions. Any taxes paid are submitted to DOR.

425 motor vehicle document fee. Find your state below to determine the total cost of your new car including the. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. While you may be used to paying sales tax for most of your purchases the bill for sales tax on a vehicle can be shocking. Publication 202 517 Printed on Recycled Paper.

Understanding California S Sales Tax

What S The Car Sales Tax In Each State Find The Best Car Price

How To Figure Out And Calculate Sales Tax Math Wonderhowto

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

السودان كومة نقع Virginia Car Tax Calculator Wrightwayaircleaningil Com

How To Calculate Sales Tax Video Lesson Transcript Study Com

Trade In Sales Tax Savings Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax Definition Formula Example

The Dual Tax Burden Of S Corporations Tax Foundation

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Sales Tax Calculator Foothills Toyota

Tennessee Sales Tax Small Business Guide Truic

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com

Car Tax By State Usa Manual Car Sales Tax Calculator

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)